Monsters of Rock: ASX producer Nickel Industries is ‘building an empire’

Mining

Mining

Indonesia is the world largest nickel producer, by a significant margin.

This is due to the development of large ‘industrial parks’ at Morowali and Weda Bay, which produce nickel pig iron for the stainless-steel sector.

Lately, there has also been a move by some of these firms to supply MHP and matte into the fast-growing battery pre-cursor industry.

So reads the title of a July presso from steel focused producer Nickel Industries (ASX:NIC).

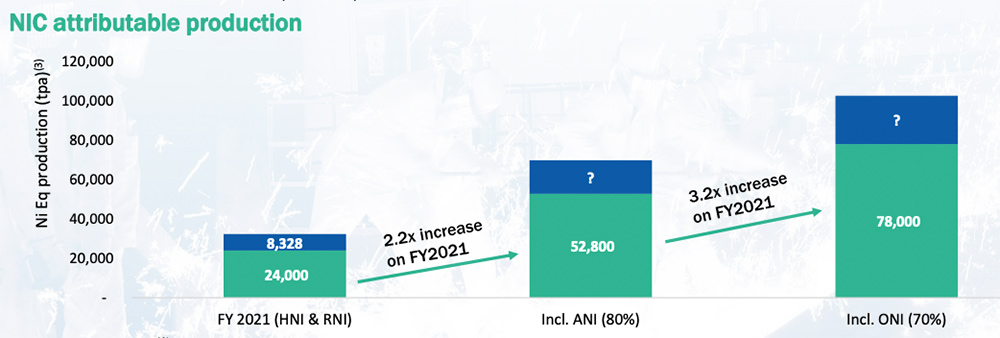

NIC will grow by x3 from FY21 levels and jump into the top 10 largest global producers when its Oracle nickel project in Morowali comes online next year.

Today, the company locked in $US225m debt funding which, along with cash reserves and future earnings, will be used to pay off a 70% project stake.

Oracle, alongside the already ramping up Angel project (80% ownership), is expected to transform NIC’s nickel production profile, resulting in a combined nameplate capacity of more than 100,000 tonnes (of nickel in NPI):

The first RKEF line at Oracle is expected to commence commissioning in October 2022, well ahead on the contracted February 2023 project delivery date, the company said today.

“The early commissioning of the Angel RKEF lines (more than 6 months ahead of schedule) and now the Oracle RKEF lines (expected to commence commissioning in October) has allowed us to significantly bring forward nickel production,” NIC managing director Justin Werner says.

“The company will soon have 12 RKEF lines in operation and approximately 100kt of attributable nickel production, placing us comfortably amongst the top-10 global producers and arguably the largest listed pureplay nickel exposure globally.”

In the June quarter, NIC enjoyed record production (15,567t nickel metal) and record EBITDA of $US103.2m.

Its margin was US$5,367 per tonne of nickel sold, down from a record +$US7,000/t the previous quarter partially due to increased power costs.

And yet the ~$3bn stock is doing poorly, down to $1.06/ share from a peak of $1.65/ share in March after Tsingshan Holding Group Co (the world’s largest nickel and stainless-steel producer) found themselves with their pants down on the wrong side of the trade — i.e. shorting nickel in a rising market.

Tsingshan, via its subsidiary Shanghai Decent, is NIC’s largest shareholder with a 18.7% stake and sole offtaker.

Despite Tsingshan ostensibly walking away from the debacle unscathed NIC kept losing value.

In May, analyst John So called the stock “cheap”.

“I think that NIC is an attractive proposition, but the real question is at what point does the market reward it for being undervalued and much cheaper than its peers?” he says.

“I think that will happen as the story plays out about how pig iron nickel can be used as a substitute for electrification of vehicles.”

In early July — when NIC was sitting at ~92c — Macquarie set a share price target of $1.30 for the stock.

That is still a +20% increase on current levels.

READ: Barry FitzGerald: It looks like nickel is back to its normal, bargain buy self

Alongside Energy, Materials (XMJ) was a big winner today and helped drag the ASX into the green.

Then standout stock was copper miner Oz Minerals (ASX:OZL), which earlier today rebuffed a $8.4bn, $25/share offer from mining giant BHP (ASX:BHP).

The news saw fellow copper plays like 29Metals (ASX:29M) and Sandfire Resources (ASX:SFR) lift as investors placed bets on future M&A action.

READ: ‘Giddy up’ say analysts as copper investors go buckwild on BHP’s $8.4bn bid for OZ Minerals