There are MANY articles on how to build a budget, pay off personal loans, improve a credit score, plan for retirement, and calculate how much you need to earn to achieve financial freedom, etc.

This isn’t one of those.

Before you start thinking about your financial goals and wealth targets, what job to pursue, how much to save or put towards investing, etc. you need to first understand your purpose. Said differently, you need to understand why you are doing what you are doing if you want to have the best chances at succeeding.

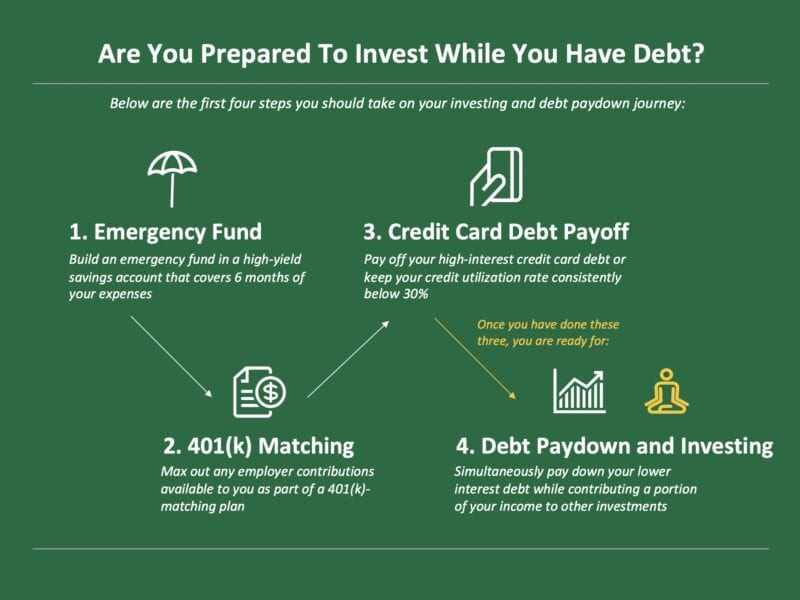

Here’s the thing: the path to financial success for most people usually includes things like building an emergency fund in a savings account, living debt free, improving credit scores to obtain a house or car loans, and ultimately building a net worth that allows for full financial security.

However, before getting into the nitty-gritty of personal finances, understanding what gives you purpose or – as some people say “your why” – is essential to your happiness and long-term success. This understanding will also help you decide which milestones are most important for you to pursue in your overall journey to sound financial health.

Overall, before establishing short- and long-term financial goals, you need to make sure they align with your personal goals and beliefs. Financial goals are meant to support your life goals. At the end of the day, finances and money are purely a way to create or support what you desire in the world.

With that in mind, this article will help you achieve the following:

- Get clear on your “why”

- Understand how you can use this information to set goals and take action

Let’s get started on answering a series of questions to help you understand your personal goals and how you want to live.

Step 1: How do you want to live?

Think of the below questions as a personal objective, or a vision for how you want to live. This is about envisioning and setting concrete goals for the lifestyle you want.

At this stage, answering a few high-level questions will help you understand a lot about yourself and your future.

Here are some questions to get started:

- How do you want to spend your time?

- Who do you want to spend time with?

- What would be a part of your dream life?

Although these questions may seem existential, let me help by giving you an example of my own answers.

Simply put, my goals for life are:

- Spend time doing the things I love

- Spend time with people I care about

- Have the flexibility (time & money) to enjoy them both

You’ll notice that at this stage it isn’t about specifics, which is fine. You are ultimately trying to distill your ideas into a set of principles and/or values.

My high-level goals above immediately enable me to get a sense of direction and understand what financial goals I will need to enable these things. For instance, the theme of flexibility becomes readily apparent. So I can quickly identify that the flexibility I seek requires some combination of achieving financial independence and/or steady income that isn’t tied to me being in once place all the time.

Your answers don’t need to look exactly like mine do, but you should at least take a few minutes and figure out at a macro level what you desire and why you are here thinking about financial goals in the first place.

Now that I’ve clarified my goals for the type of life I want to live, it’s time to translate these goals into more specific items.

Step 2: What do you want & why do you want it?

The next step is to make your goals more tangible by identifying what you want in your life. To do this, you should spend some time coming up with answers to the following questions.

This is a two part exercise where you will define:

- What you want

- Why you want it

To start, as you work through “what you want”, here are the questions you should answer to help you hone in on specifics.

Reflection Questions:

- Where do you want to live?

- Do you want to have kids?

- What do you like to do with your free time?

- Do you want to own a home (or multiple homes)?

- Do you want to travel?

Once you have a pass at these questions, it is now time to go a little bit deeper and answer why you want each of these things.

In my experience, answering “why” is actually most important.

Understanding your “why” is critical because it is the foundation of your motivation to achieve the goals you set. This is the thing that helps you stay focused and gets you up early, working hard, and hustling even when times get tough.

To show you what this looks like, here are a few examples of my own personal answers to this exercise below:

Where do you want to live?

- My Answer: I want to live in the mountains and have the flexibility to see friends and family across the country.

- Why do I want this: I feel connected to the mountains and am genuinely a happier person when I am living near them.

Do you want to have kids?

- My Answer: Yes. Likely a few, especially if my wife has her way 🙂

- Why do I want this: I grew up without having a dad in the house. I am deeply motivated to be a father and provide those nurturing experiences that I did not get growing up.

What do you like to do with your free time?

- My Answer: I love snowboarding, mountain biking, and traveling. I also enjoy pottery, eating out, and hiking.

- Why do I want this: On a daily basis, being physically active and outside (with a touch of adrenaline) makes me a happier and healthier person. Creative outlets and new experiences keep me engaged.

Do you want to own a home (or multiple homes)?

- My Answer: I am not as attached to owning a home, but I do enjoy designing physical spaces. I likely want a “family home” someday.

- Why do I want this: I enjoy having a dedicated place that feels like our own and can host family & friends. I love to build things, and look forward to making a place home.

Do you want to travel?

- My Answer: I love to travel and explore new spaces. Both my wife and I get stir crazy if we have been in any place for too long.

- My Why: Travel and understanding different peoples, places and cultures really helped me be a more compassionate and understanding human.

Hopefully after reading the above you have some ideas of your own!

Important Note: If you cannot identify and write down a clear “why” for any of the things you say you want, then it is possible you should reconsider your goal. |

While it may be that it takes you some time to clearly articulate your why – and this is 100% okay – it is also possible that it is something you don’t really care about on a deeper level.

Be wary of any “thing”, especially financial or superficial, you think you want but aren’t sure why. These are the things that most often lead to buyer’s remorse, feel like a drag to achieve, or cause you to lose motivation after getting part way towards it.

Simon Sinek, bestselling author of Start With Why and Find Your Why, is a good example of someone who has recently brought greater attention to the important link between what you value and your ability to create a life of fulfillment. He highlights a key point; understanding your “why” will make you more capable of achieving your goals.

Bottom Line: Why do you want the things you want? Make sure the why is deeply meaningful, otherwise you won’t follow through with what it takes to get here. |

Step 3: Define 3-4 actions to achieve your goals

Great. You have information on how you want to live. Now what? With this information, it’s time to craft concrete goals and take action to achieve your ideal life.

At this stage, I find a few simple actions or outcomes the best place to focus your time and attention.

These should be things that, if done consistently, are sure to put you in a very good place to achieve your financial goals.

My favorite goal-setting structure to document this is the Objective and Key Result (OKR) approach because it acts as a simple and powerful framework to clarify your goals.

The OKR approach can be be applied not only to financial goal setting, but to anything else you hope to accomplish. As we’ve emphasized, establishing financial goals usually goes hand-in-hand with establishing complementary personal/lifestyle goals, and using OKRs will help you achieve both.

Objectives are memorable qualitative descriptions of what you want to achieve.

Key Results are a set of outcomes that measure progress towards the Objective.

The Objective you set is supported by a few specific key results that clarify how the goal will be achieved.

Here is an example of my financial goals as an OKR:

Objective: Have a job and financial situation that enables me to spend lots of time with my kids, live in the mountains, and travel regularly

- Key result 1: Create a family budget that allows us to consistently save and invest 30%+ of our monthly income

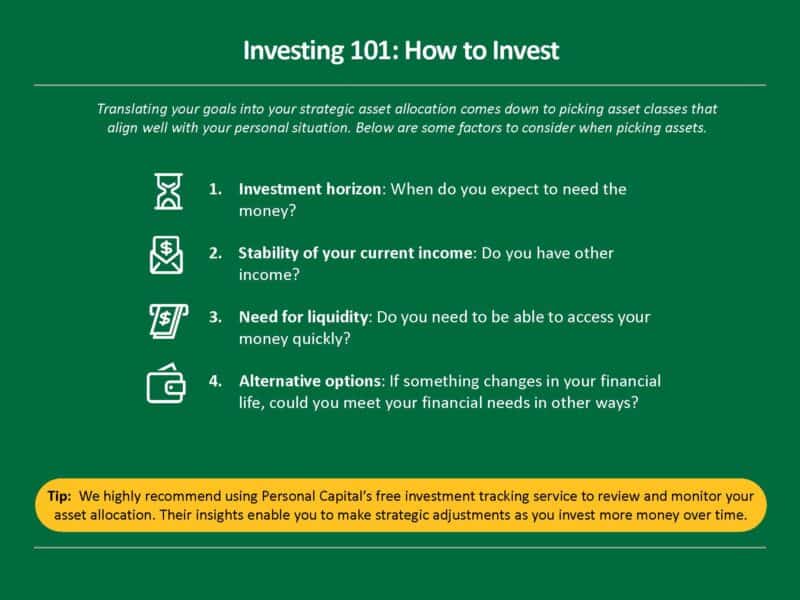

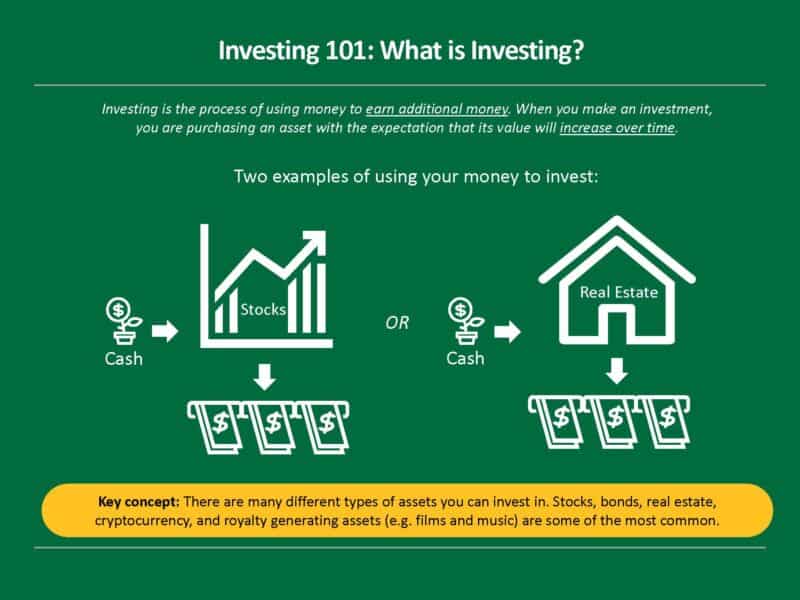

- Key result 2: Build a diversified portfolio of investments (stocks, bonds, real estate, crypto) that is 25x our annual expenses as a family

- Key Result 3: Work in a career that provides education and access to business and investment opportunities

Here are examples of key results related to financial planning (and good general personal finance principles) that you can think about and potentially incorporate into your plan:

- With every bonus or gift I get, 70% will be saved or invested and 30% will be for “fun money”

- Fully fund my IRA account each year (~$6k) before taking any vacations

- Save a 20% down payment, and max out my retirement account contributions each year before buying a family home

- Buy 1 cash flowing rental property every 3 years

- Fully fund a college 529 investment account each year after our child is born

- Start my own business or freelancing side hustle this year

As you can see in the above, there are lots of actions that can lead to great financial outcomes and goals. The important thing is that you pick and commit to a few very tangible actions or behaviors that will support your goals.

It is hard to predict exactly what job you will have, and how you will achieve your goals. But, if you focus on a set of behaviors and actions that support them (like consistently saving and investing) you are very likely to get there.

Final Thoughts

It’s so easy to jump straight into setting personal finance and investment goals. But by having and understanding your “why” first, you’ll be able to create financial goals that set you up for long-term success. It’s what will fuel you when things go well and keep you going when things get tough.

If you haven’t already, we highly recommend spending some time going through the above steps and writing out your own answers. Your future self will thank you!

Want an easy way to answer these questions? Download this do-it-yourself workbook.

For greater details on what you can do to support your goals, check out the following posts:

Disclosure: This article may contain references to products or services that we use and recommend. At no cost to you, we may receive compensation when you click on the links to those products or services. This helps us keep the site free for everyone.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.