The expectations consumers have around personalized experiences — expectations borne from innovations in industries from retail to tech — are quickly becoming requirements for financial services firms. The acceleration of digital innovation in banking and beyond has only underscored the urgency for financial leaders to provide data-driven, personalized experiences that stand up to the competition.

While most financial firms are well aware that personalization is quickly becoming table stakes, why do some organizations enact winning personalization initiatives while others lag? Where do they stand when it comes to consumer expectations?

According to a recent study conducted by Forrester Consulting on behalf of Blend, the answer to these questions lies in the maturity of their personalization efforts. We explored what consumers expect, the challenges and opportunities bankers face in meeting those expectations, and what strategies and capabilities separated those that were successful at personalization from the rest. In the end, banks with more mature personalization efforts are not only succeeding at their own stated business performance goals, they aren’t spending a fortune to do it.

To illustrate the current state of personalization in financial services, we’ve pulled out some of the highlights from the study below.

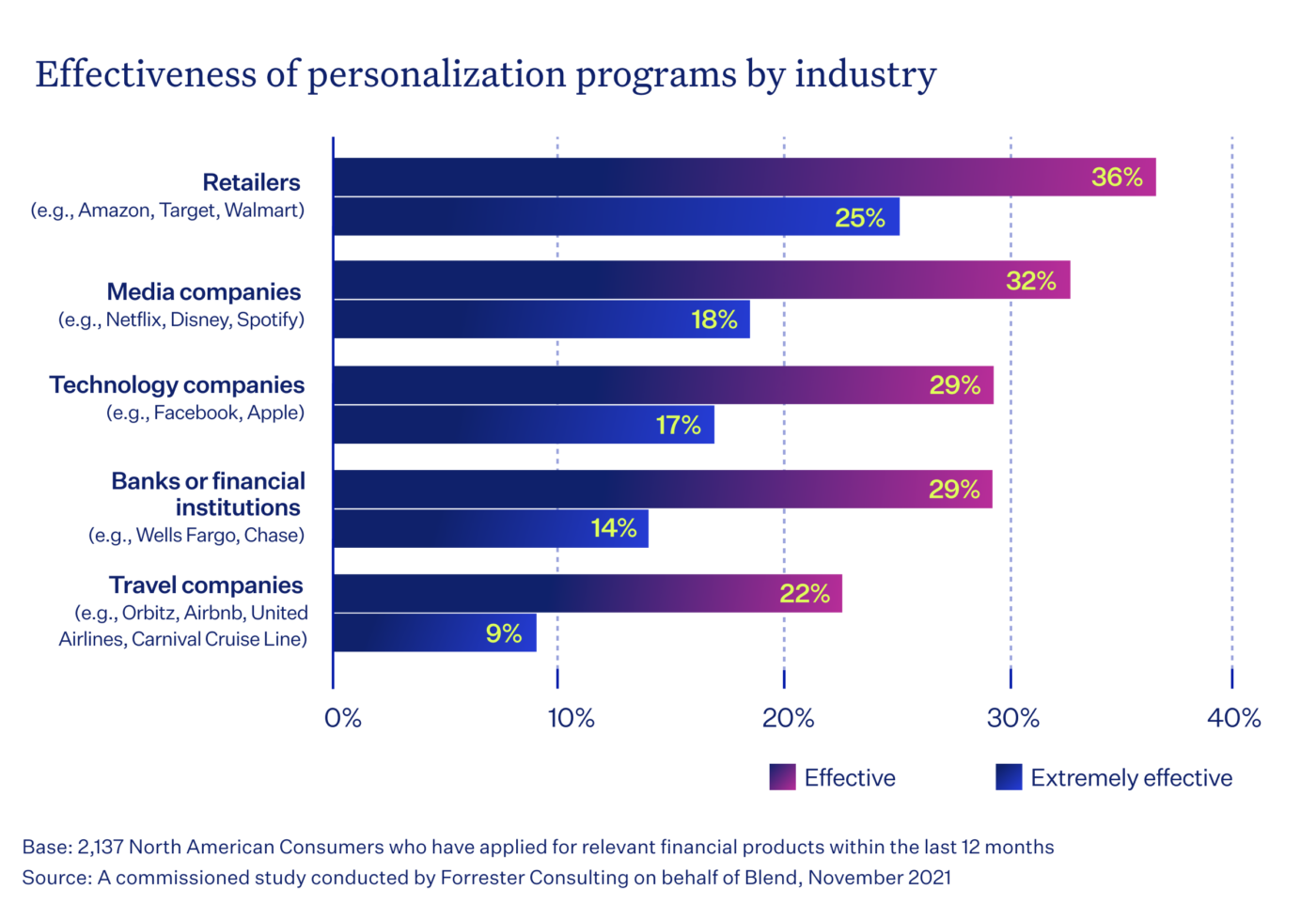

Financial institutions have fallen behind other industries in effective personalization

Financial institutions are seen as being relatively poor at personalization, ranking fourth out of five industries. Just 14% of banking customers described these institutions as being “extremely effective” at delivering contextually relevant experiences and product offers today. Other industries, especially retailers, have invested significantly in creating tailored experiences for their customers. Not only has it set them apart — one in four consumers believe retailers are extremely effective at providing contextually relevant experiences — it has altered how consumers look at other industries. Now, FSIs must contend not just with the services offered by their competitors but must also grapple with these consumer expectations that have arisen in other industries if they want to remain competitive.

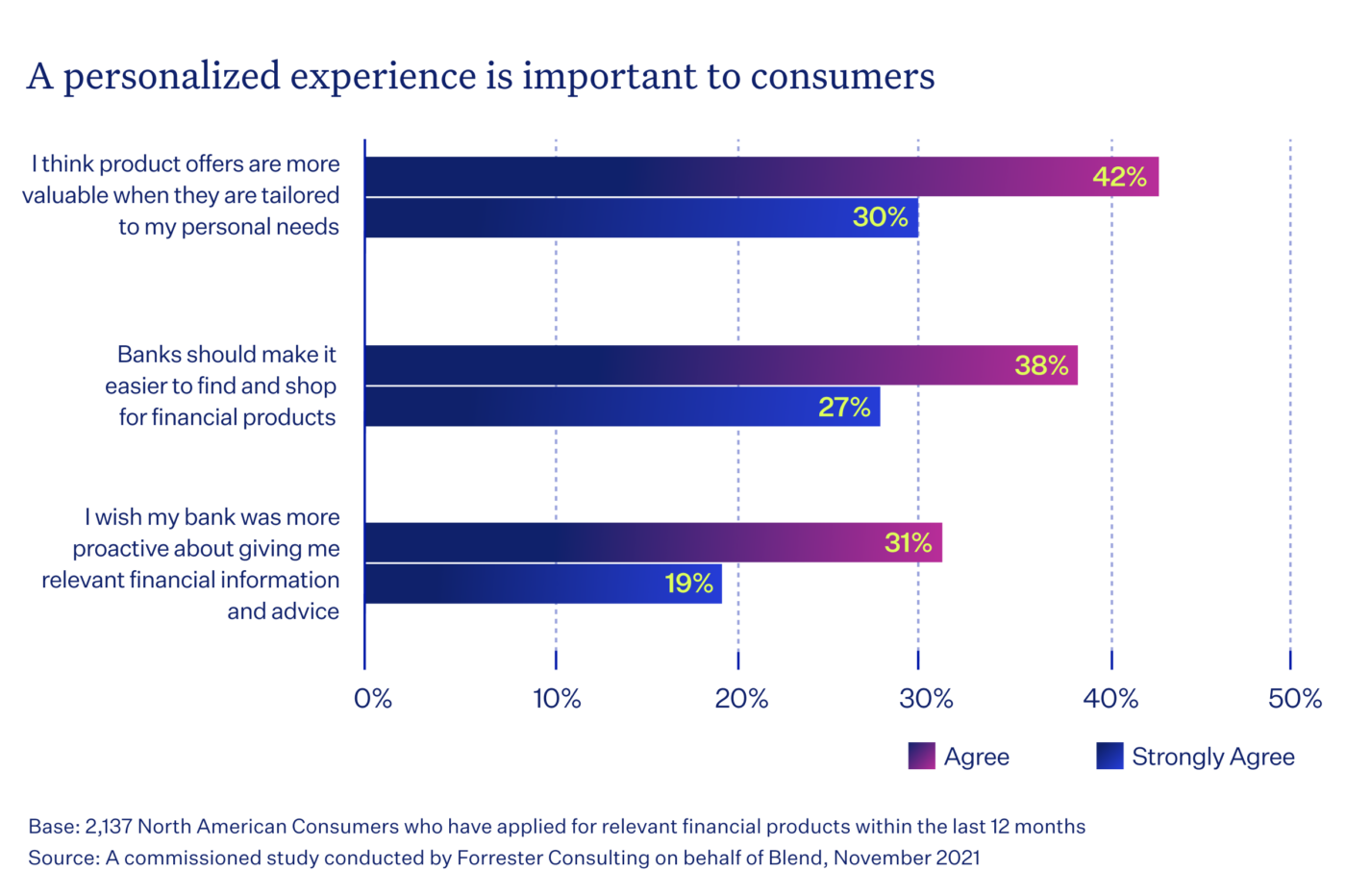

What consumers want in a financial institution

Consumers want reduced friction and increased value when they interact with their institution. The way they expect that to manifest is through tailored experiences that account for preferences and needs. Nearly three-quarters of banking customers reported that product offers are more valuable when they’re contextually relevant, and 65% believe institutions should make it easier to find and shop for financial products today. More than half of consumers wanted banks to use information they already had about them to make experiences easier or more convenient.

While consumers may generally see banks as less advanced when it comes to personalization, they see these factors as differentiators and may be willing to prioritize the institutions that make an extra effort.

Why some firms lead and others lag

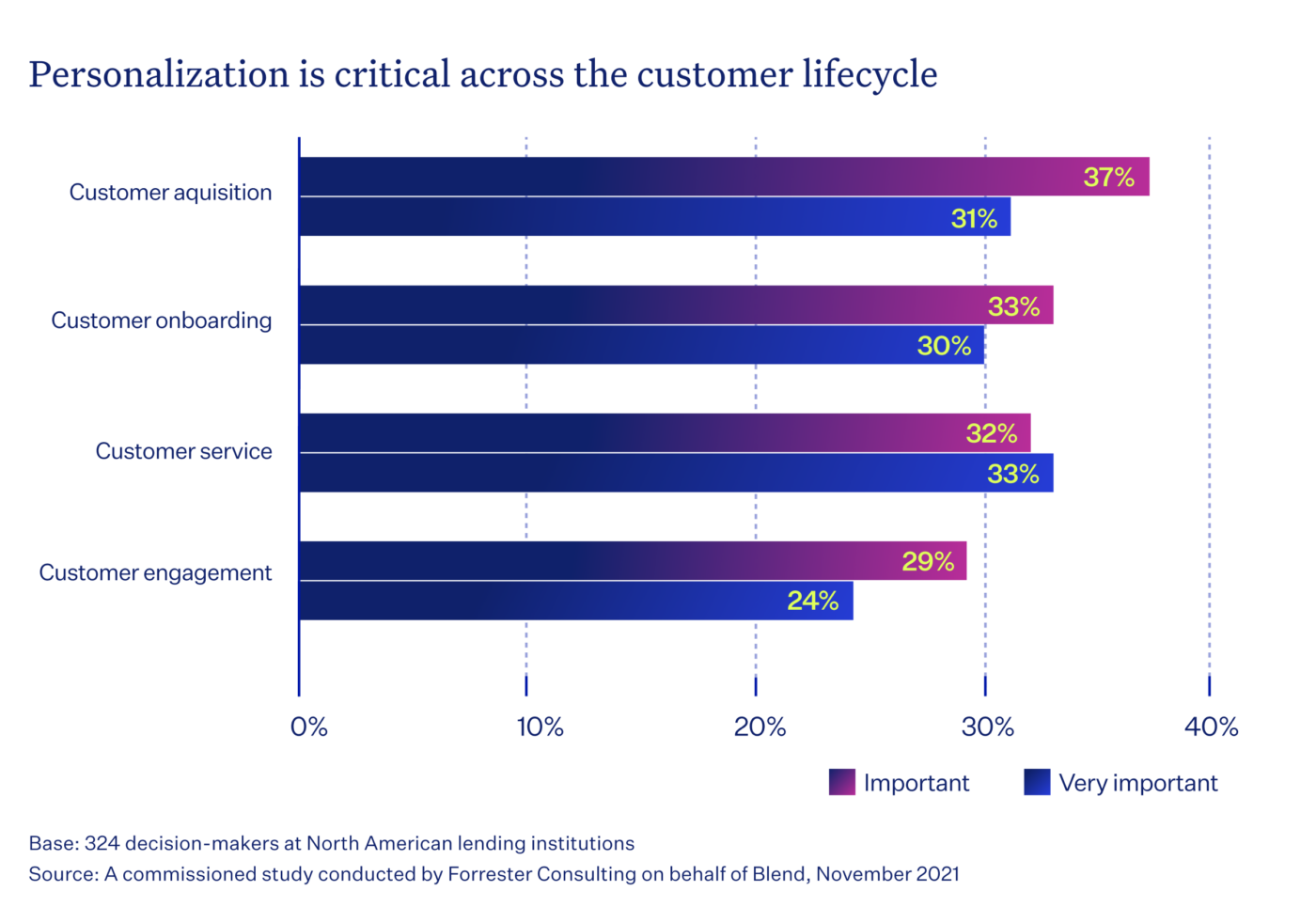

Moreover, decision-makers at financial services firms also understand the importance of personalization. Nearly three-quarters of respondents are planning to increase investment in personalization, and 28% plan to increase it substantially. And they’re spending their money personalizing touchpoints across the customer lifecycle.

Respondents were most likely to say that personalization was an important driver for their customer acquisition strategies (68%), but also nodded to its role in more effective customer service (65%) and onboarding (62%). It’s not surprising that banks are prioritizing the personalization of customer acquisition — it’s a direct way to show value and a logical starting place.

If both professionals and consumers see the inherent value in personalization, what is stopping banks from executing on it? Respondents to the survey highlighted several challenges they face, including the capture and management of consumer data, concerns over how to personalize effectively, and being able to deliver personalized experiences across all product lines.

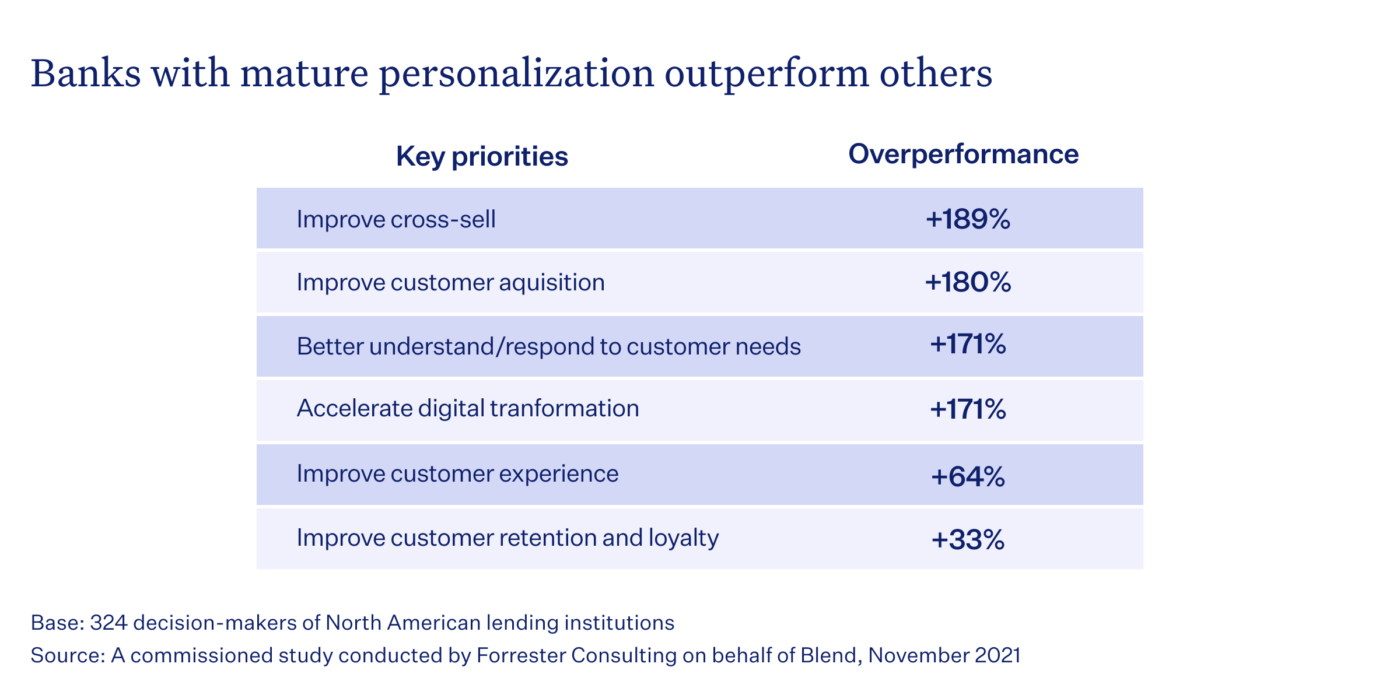

When Forrester compared the respondents with more and less mature personalization, they found more mature institutions were nearly three times more likely to outperform their goals in cross-sell, and customer acquisition, compared to low-maturity banks, and 171% overperformed on their own stated goals for digital transformation. Importantly, they also reported being better able to understand and respond to customer needs.

Interestingly, the more mature firms were controlling their costs at more or less the same rate as the banks that weren’t doing much personalization, suggesting that while there is much to consider when developing a personalization strategy, cost may be less of an issue than standard beliefs would suggest, especially if you consider the ROI of a strong personalization initiative.

Leading providers are personalizing holistically

The firms that stand out are approaching personalization strategically and holistically with a clear focus on customer value. Personalization is more than knowing a customer’s name or tailoring their acquisition. Personalization encompasses the entire customer journey and provides an experience that underscores your value to your customers through a better understanding of them.

While complete personalization may be the end goal, it doesn’t need to be the first step. It’s just as important to capture quick wins that can demonstrate value and provide a foundation for expanding personalization efforts.

Now is the time to rethink your digital strategy

The financial industry is changing fast. One thing is clear: to build deeper digital relationships, banks must enact meaningful personalization. Rather than another box to tick on the digital transformation journey, organizations that win with proactive and personalized experiences have a holistic and strategic approach to personalization across the entire customer lifecycle.

Learn more about the strategies of personalization winners in the complete study, and chart a course to capture the short and long-term benefits that personalization can deliver.