Highlights:

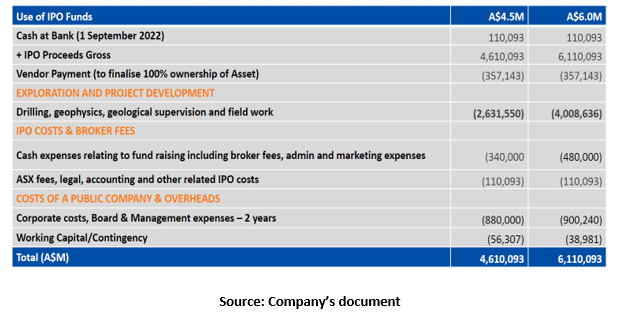

- Aeramentum Resources (AEN) is raising AU$4.5 to AU$6 million via an IPO at an issue price of AU$0.20 per share.

- The company is a Cyprus-based copper and battery metal explorer.

- Key factors that make Aeramentum stand apart.

Battery metals have been drumming up a lot of interest these days. The increase in the number of battery mega-factories under construction and planning phase is a testimony to this fact. Be it metal and mining companies, Original Equipment Manufacturers (OEMs) or governments – no one wants to be left out especially at this time when the battery market continues to gaining traction particularly in the face of the current energy crisis.

In this backdrop, a Cyprus-based copper and battery metal explorer Aeramentum Resources (AEN), eyeing to join the growing number of EU Battery Metals plays, is set to hit the Australian Stock Exchange (ASX) through an IPO focused on a Nickel-Copper-Cobalt-Gold project on the EU island of Cyprus.

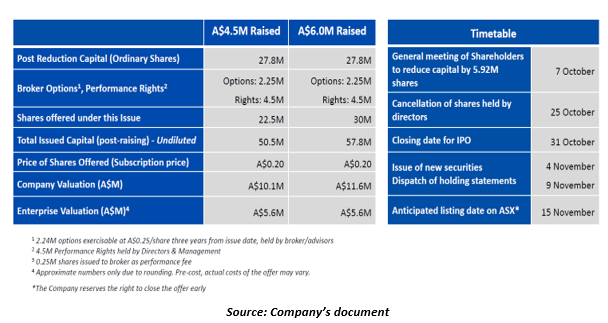

As per Aeramentum, the IPO will close on 31 October 2022, and its shares are expected to commence trading on the ASX on 15 November 2022 (tentative date). The company is raising AU$4.5 to AU$6 million at an issue price of AU$0.20 per share. IPO’s details and timeline are shown via an infographic attached below:

The company acquired the Treasure Project in 2021, which has since been expanded to include eight permits, two of which are in the application phase. The proceeds will fund diamond drilling on 3 high grade targets with high grade copper (18%), nickel (11%) and cobalt (3%) revealed in past drilling and adits.

As per Aeramentum the Treasure Project has significant cobalt potential- one of the more expensive components of the lithium-ion batteries. Up to 20kg of cobalt is required in an average EV, with the demand for EVs growing exponentially, and the factories designed to use cobalt in the batteries already under construction, the demand for battery metals is expected to remain firm.

What makes Aeramentum stand apart from rivals

- Polymetallic battery metals potential: Potential for multiple battery minerals including copper, gold, nickel and cobalt with an attractive outlook for all metals.

- Brownfields drilling: Drilling known orebodies and surface outcrops increase discovery outcome. As per the company, historical drilling is all shallow unlocking further upside as AEN drills deeper towards establishing maiden resources (similar deposits globally such as Bou Azzer are not depth constrained).

Past sampling of exploration adits from the 1950s shows grades including 8m @ 11.2% copper and 4m @ 16.8% copper at Laxia and 14.5m @ 3.5% nickel, 0.6% cobalt at Pevkos.

- Republic of Cyprus is a stable, safe jurisdiction with a history of large-scale copper mining and over 70Mt mined mostly up until the 1970s. The government supports the industry with a low corporate tax rate of 12% and low royalties, in addition to the inherent infrastructure and labour cost advantages.

- Strong tailwinds: There is a general consensus among market participants that the demand for copper, cobalt and nickel in Europe will grow in the coming years with the cessation of IC engine powered car manufacturing.

- Downstream users active: Numerous car makers and off-takers have been inking new deals with mining companies to secure the supply of rare metals. Recently, Managem Group, the Moroccan owner of the Bou Azzer mine, signed a deal with auto major Renault for a supply 5,000 tonnes of cobalt sulfate annually starting from 2025.

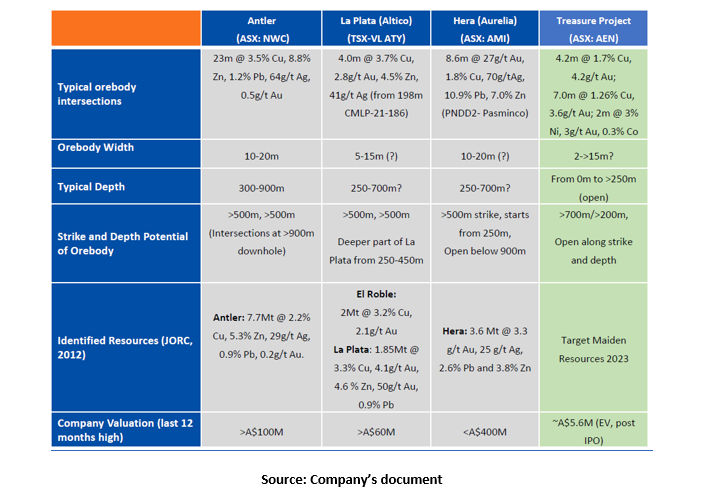

The peer comparison is highlighted in the attached infographic:

Aeramentum believes that it is well placed to cater to the burgeoning demand for battery metals in Europe. The company’s Brownfield Treasure Project is drill-ready (rig in country) and waiting to unearth the riches that lie beneath the ground, undisturbed for 70 years.