Its been a mixed year for the commodities market with fast-changing geopolitical situations like the Russia-Ukraine war and the COVID-19 cases rising and the subsequent lockdowns in China. Supply has been impacted across the board and the deep fluctuations in energy and metal prices reflect that as the world tried to come out of the pandemic at large.

With the world also moving at top speed towards electric vehicles to curb the pollution menace and thus help fight the impending climate crisis, battery components such as lithium and nickel outperformed the other metals to shine the brightest.

Energy

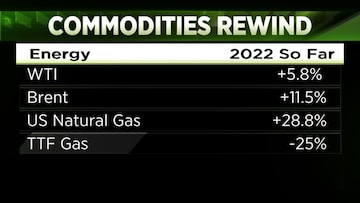

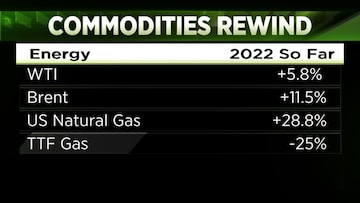

The year 2022 is ending on a high note for WTI and Brent crude, with both closing the year nearly 5-10 percent higher on the back of Russia's decision to cut output by nearly 5-7 percent in the first quarter of 2023. The prices had declined by 45 percent from the peaks in the course of the year before this current uptrend. Russian oil is trading above $80 per barrel.

Gas prices also took divergent paths this year. In the US, gas prices gained by 28 percent because of record exports, its Arctic winter, and inventory decline. However, TTF and European Union gas prices have declined as Europe, on average, right now has 83 percent of its capacity of gas holdings.

The best performance in the energy pack clearly came from coal which fired up 138 percent due to under-investment in the sector and higher electricity prices driving a large section of people to turn to coal. The first half of 2023 is expected to mirror this.

Metals

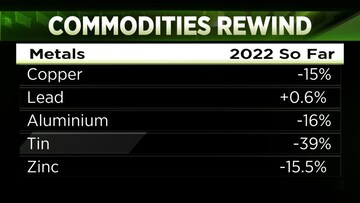

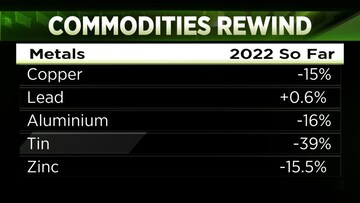

Copper prices reached an all-time high this year before slipping and aluminum climbed down 35-45 percent from its peaks, ending the year 15-16 percent lower. Zinc prices saw an extreme decline on the back of weaker demand for galvanisation. Zinc inventories in Shanghai and LME were at record lows.

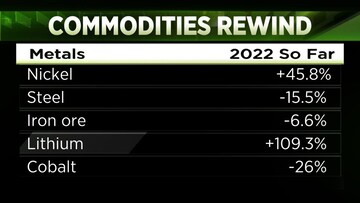

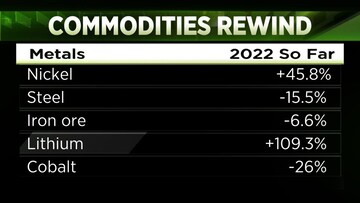

The story of the year clearly belonged to nickel — $100,000 per tonne before it was forced down to $48,000 by LME, two days of suspension, and a whole lot of surveillance work. Even with all of that, nickel is closing the year with 45 percent gains.

Also Read | Deepika Padukone to Priyanka Chopra, celebs who started their own brands in 2022

It is a negative closing for steel and iron ore. Last year, cobalt prices gained by 80 percent while this year it has seen profit taking. Lithium's trend of best gains continued, the much-in-demand metal closing 109 percent higher on the back of weaker supplies and strong demand from the electricity and renewables sectors.

Precious metals

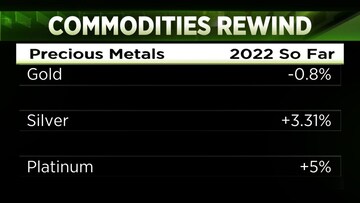

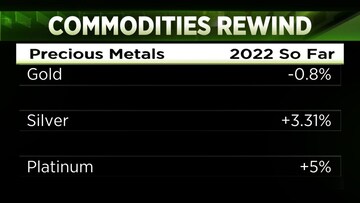

Precious metals too made stellar strides in 2022. Gains came in for gold in the Indian markets but not so much in dollar terms. Silver clearly outperformed the yellow metal, 3 percent up in dollar terms and nearly 15 percent up in the rupee terms.

Platinum shone in the international markets, up 5 percent, compared to a 7 percent decline last year.

To read all our 2022 year-enders, click the tab below

With the world also moving at top speed towards electric vehicles to curb the pollution menace and thus help fight the impending climate crisis, battery components such as lithium and nickel outperformed the other metals to shine the brightest.

Energy

The year 2022 is ending on a high note for WTI and Brent crude, with both closing the year nearly 5-10 percent higher on the back of Russia's decision to cut output by nearly 5-7 percent in the first quarter of 2023. The prices had declined by 45 percent from the peaks in the course of the year before this current uptrend. Russian oil is trading above $80 per barrel.

Gas prices also took divergent paths this year. In the US, gas prices gained by 28 percent because of record exports, its Arctic winter, and inventory decline. However, TTF and European Union gas prices have declined as Europe, on average, right now has 83 percent of its capacity of gas holdings.

The best performance in the energy pack clearly came from coal which fired up 138 percent due to under-investment in the sector and higher electricity prices driving a large section of people to turn to coal. The first half of 2023 is expected to mirror this.

Metals

Copper prices reached an all-time high this year before slipping and aluminum climbed down 35-45 percent from its peaks, ending the year 15-16 percent lower. Zinc prices saw an extreme decline on the back of weaker demand for galvanisation. Zinc inventories in Shanghai and LME were at record lows.

The story of the year clearly belonged to nickel — $100,000 per tonne before it was forced down to $48,000 by LME, two days of suspension, and a whole lot of surveillance work. Even with all of that, nickel is closing the year with 45 percent gains.

Also Read | Deepika Padukone to Priyanka Chopra, celebs who started their own brands in 2022

It is a negative closing for steel and iron ore. Last year, cobalt prices gained by 80 percent while this year it has seen profit taking. Lithium's trend of best gains continued, the much-in-demand metal closing 109 percent higher on the back of weaker supplies and strong demand from the electricity and renewables sectors.

Precious metals

Precious metals too made stellar strides in 2022. Gains came in for gold in the Indian markets but not so much in dollar terms. Silver clearly outperformed the yellow metal, 3 percent up in dollar terms and nearly 15 percent up in the rupee terms.

Platinum shone in the international markets, up 5 percent, compared to a 7 percent decline last year.

To read all our 2022 year-enders, click the tab below

First Published: Dec 27, 2022 11:13 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!