St George Mining Ltd (ASX:SGQ) has entered into an agreement under which it has been granted an option to acquire 100% of the Woolgangie Project in the Eastern Goldfields of Western Australia.

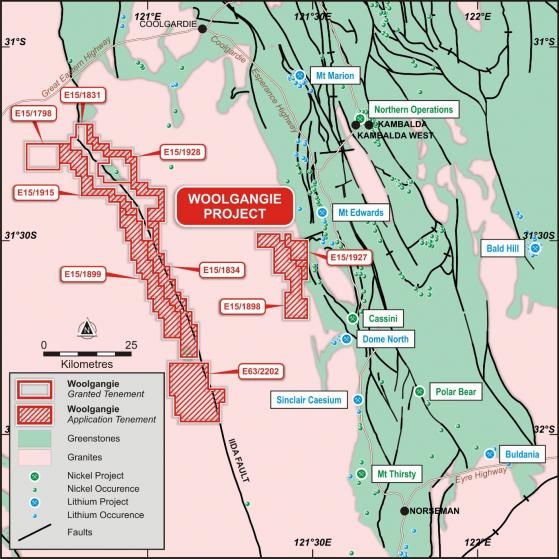

Woolgangie is a package of nine exploration licences (granted or in application) with a total area of 1,200 square kilometres.

The project covers a large area within a prospective belt that has received only superficial previous exploration for lithium bearing pegmatites and limited exploration for other types of mineralisation.

St George believes that systematic exploration for lithium and other critical metals offers an excellent opportunity for a new discovery.

Map of the Woolgangie Project tenement package.

St George executive chairman John Prineas said: “This acquisition expands our project portfolio in Western Australia into a highly prospective but largely overlooked region and stamps St George as a dominant player in this area.

“The option over Woolgangie provides a strategic and cost-effective pathway to grow St George’s already substantial lithium and critical metals opportunities in Western Australia, complementing our success at Mt Alexander and the potential of our other projects including Paterson, Ajana and Broadview Projects.

“We are excited by the potential for systematic exploration at Woolgangie to deliver a major discovery at this highly prospective but underexplored landholding.”

Two strategic areas

The Woolgangie tenements cover two strategic areas.

One area, the western tenements, encompasses ~70km of strike along the highly prospective Ida Fault – a major crustal boundary that controls multiple major minerals deposits within WA.

The other area, the eastern tenements, is proximal to an established lithium region that hosts several significant lithium deposits and operating mines.

Woolgangie complements St George’s focus on building a portfolio of highly prospective lithium and other critical metals projects across Western Australia.

Importantly, significant exploration activity is planned at Woolgangie for 2023 including field mapping and outcrop sampling, soil surveys, airborne magnetic surveys, ground electromagnetic surveys and drilling.

Summary of key terms

- Consideration payable to the vendor under the option agreement includes $400,000 as an option fee satisfied by the payment of $200,000 cash and $200,000 worth of St George shares.

- $1,000,000 worth of St George shares are to be issued to exercise the option on or before 2 February 2025.

- $1,000,000 as a milestone payment satisfied by the payment of $500,000 cash and $500,000 worth of St George shares if St George announces a JORC resource for any mineral on one or more of the acquired tenements on or before 5 years from completion of the option agreement.

- 0.5% net smelter royalty payable to the vendor in regard to any mineral products produced and sold from the tenements.

The tenements along the Ida Fault are considered prospective for lithium as well as ionic clay-hosted rare earths and nickel-copper sulphides.

Numerous pegmatites have been mapped for many kilometres within the western tenements along the Ida Fault and also within the eastern tenements along the margin of the known lithium province.

No previous systematic exploration for lithium appears to have been conducted within the project area.

The geological setting of the western tenements has analogies to the Mt Ida district that includes Red Dirt Metals’ Mt Ida Project (MRE: 12.7 Mt @ 1.2% Li2O) 1 and St George Mining’s Jailbreak lithium prospect.

Rare Earth Elements (REE) prospectivity

Historical drilling in 2010 by Mincor Resources identified several wide zones of rare earth anomalism while exploring for nickel sulphides.

The preliminary interpretation is that the REE anomalism is more likely to relate to ionic clay-hosted rare earth mineralisation rather than carbonatite hosted mineralisation.

Copper prospectivity

Historical drilling by Emu NL (ASX:EMU) encountered extensive near-surface copper sulphide mineralisation that warrants further follow-up exploration.

A review of historical data is ongoing and further announcements of previous results and work programs planned at the Woolgangie Project will be made soon.