Australian mining companies Rio Tinto Limited (AU:RIO) and BHP Group Ltd. (AU:BHP) will report their earnings for the period that ended on December 31, 2022, in February 2023.

Analysts expect positive earnings from RIO and BHP, driven by their higher production numbers for copper and iron ore and improved guidance for the next year. The higher unit costs of production could slightly impact the margins of these companies.

The TipRanks Earnings Calendar is a perfect tool for investors to stay up-to-date during this earnings season. This tool is now available across seven different markets and presents crisp and updated information on the upcoming earnings of the companies.

Let’s have a look at these companies in detail.

Rio Tinto Limited

Rio Tinto is among the largest mining companies in the world. The company has a diverse product portfolio that includes iron ore, aluminum, copper, lithium, diamonds, and so on.

Rio will report its Q4 and full-year earnings for 2022 on February 22, before the market opens. The consensus EPS forecast for the quarter is AU$4.48 per share, down from AU$5.69 in the previous year’s quarter. The total product revenue for the company is expected to be $57.1 billion, and underlying earnings are expected to be around $13.3 billion in 2022.

The analysts are upbeat about the earnings after the company issued its Q4 trading update in January 2023. The Pilbara iron ore production grew by 6% as compared to Q4 2021 numbers. For the full year 2022, the company’s iron ore production increased by 1%. The company also expects cash costs to be on the higher side of the guidance range of $19.5 and $21.0 per tonne, due to higher inflation and labor costs.

The company’s copper production was 6% higher in 2022, and it is looking to further enhance it with its acquisition of Turquoise Hill Resources Ltd. in December 2022. The company updated its copper production guidance for 2023 from 550–600 thousand tonnes to 600–655 thousand tonnes.

After the company released its production numbers, analyst Paul Young from Goldman Sachs reiterated his Buy rating on the stock at a target price of AU$134.4, indicating an upside of 8%. Young is bullish on the stock considering Rio’s iron ore production and increased guidance on copper production.

Is Rio a Good Stock to Buy Now?

The company’s stock has enjoyed a huge growth of 63% in the last three years.

Overall, RIO stock has a Hold rating on TipRanks, with an average target price of AU$116.82. This is 6% lower than the current price level.

BHP Group Ltd.

BHP is an Australia-based mining company producing iron ore, copper, nickel, and coal.

The company will report its Q2 and half-yearly earnings for the fiscal year 2023 on February 21. The forecasted EPS of AU$1.94 per share is higher than the EPS of AU$1.65 in the same quarter of the previous year.

Similar to Rio, BHP also delivered strong operational numbers for the first half of its fiscal year 2023. The company’s Western Australia iron ore production reached a record of 146 million metric tons, thanks to strong supply chain management. BHP’s copper production in the first half increased by 12% to 834.4 thousand tonnes, mainly due to higher output after the planned maintenance activities in the previous year.

The production guidance for the full year remains unchanged, and unit cost numbers are expected to be in the upper range of their respective guidance. This was impacted by higher inflationary costs and wet weather conditions.

Ahead of its earnings release, Berenberg Bank analyst Richard Hatch has upgraded his rating from Hold to Buy at a target price of AU$56.10. This implies an upside of 16.5%.

Is BHP a Buy, Sell, or Hold?

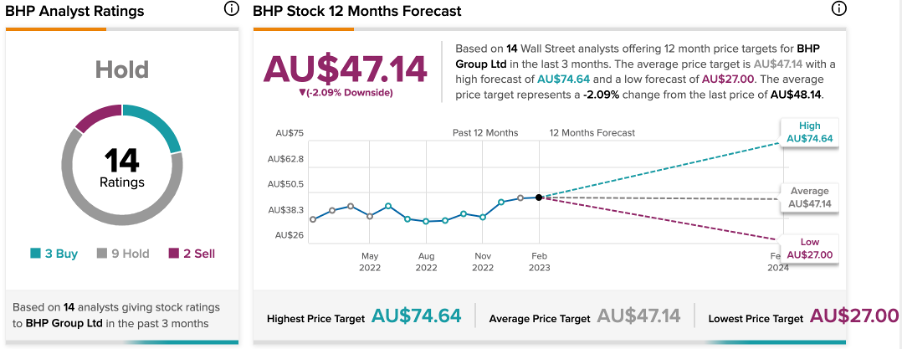

According to TipRanks, BHP stock has a Hold rating, based on three Buy, nine Hold, and two Sell recommendations.

The stock has an average target price of AU$47.14, which is 2% lower than the current price.

Conclusion

Both Rio and BHP have posted strong production numbers, indicating stable earnings in the upcoming quarter. Analysts remain positive on the results and the long-term outlook, with mixed opinions on further share price growth.