Nickel still crucial for EV batteries: Industry players

Industry players in the world's largest nickel producer are adamant about the future of the mineral in electric vehicles despite a resurgence in demand for lithium iron phosphate batteries.

Change Size

I

ndonesian manufacturers are confident about the future of nickel as material input crucial for producing electric vehicle batteries, despite the increasing popularity of batteries made using lithium iron phosphate (LFP).

LFP batteries, which do not contain either cobalt or nickel, have been clawing back market share from nickel-rich alternatives over the past two years, almost entirely due to their use by the United States’ Tesla Inc. and China’s BYD Auto Co. Ltd., both industry giants.

The latest figures published by consultancy Adamas Intelligence show that LFP batteries’ market share jumped from 17 percent in January 2021 to 26 percent in January 2022, and then to 31 percent last September.

Its market growth is expected to continue as electric carmakers seek to lower costs in an increasingly competitive arena amid tightening nickel and cobalt supplies, at a time when iron and phosphorus are still widely available.

Gilarsi W. Setijono, president director of PT VKTR Teknologi Mobilitas, the electric vehicle (EV) manufacturing arm of conglomerate Bakrie & Brothers, said the growing market share of LFP batteries was no cause for concern for nickel-rich Indonesia as the world shifts up a gear in the transition to EVs.

“Scientists are creating more alternative battery chemistries aside from LFP and lithium nickel manganese cobalt oxide [LNMC] to meet expected skyrocketing demand,” he told The Jakarta Post last Friday.

Global demand for EV batteries is projected to grow 30 percent annually, reaching close to 4,500 gigawatt-hours (GWh) globally by 2030, McKinsey & Company said in a report. The management consulting firm also said it expected the battery value chain to increase tenfold between 2020 and 2030 to an annual revenue of US$410 billion.

Read also: Indonesia doubles down on EV incentives to hit tipping point

“The combined LFP and LNMC battery supply at present would not be enough to supply even half of the EV demand if, say, annual demand were to reach 90 million worldwide [...],” Gilarsi replied, when asked whether Indonesia should worry about its lack of lithium reserves.

According to the International Energy Agency (IEA), nickel battery chemistries like LNMC and lithium nickel cobalt aluminum oxide (LNCA) have come to dominate the market because they offer higher energy density, or how much energy a battery contains compared to its weight, thus offering a longer driving range as well as lower battery strain.

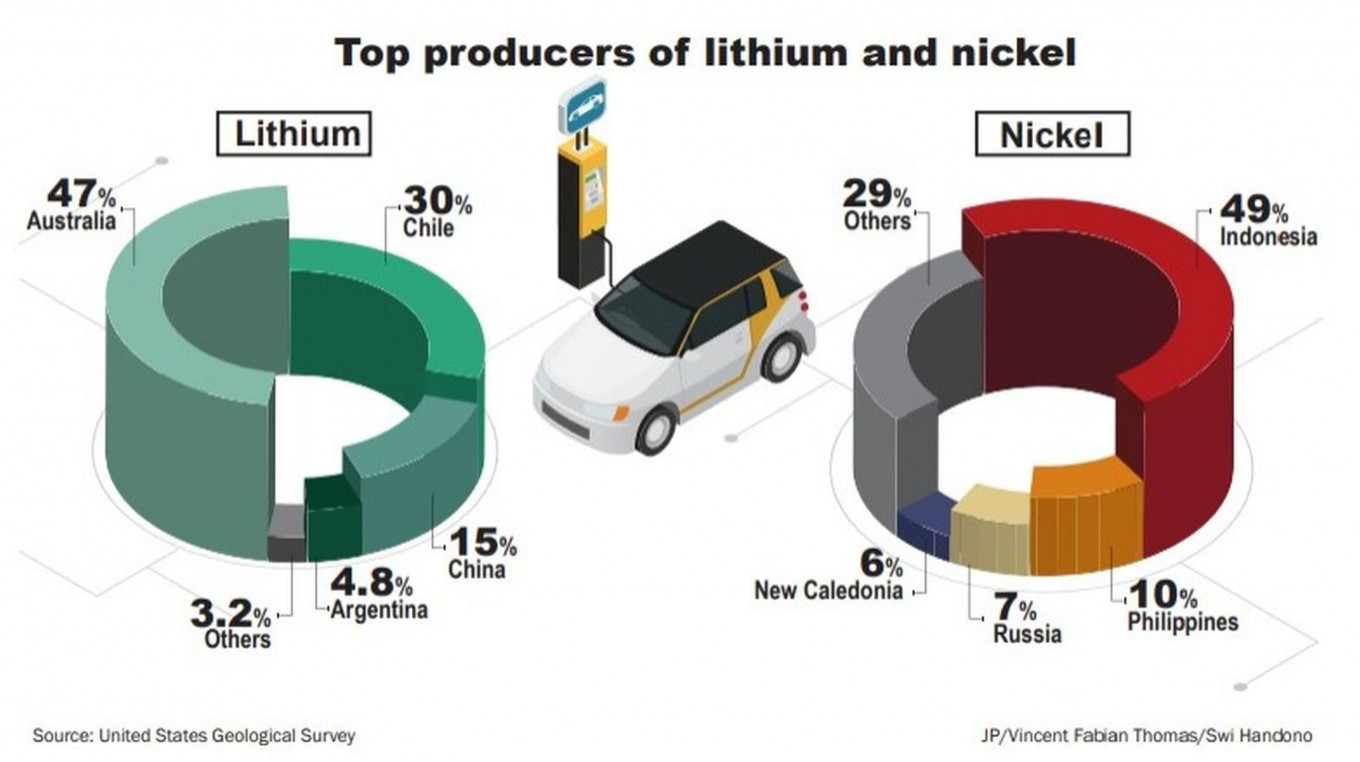

Dany Amrul Ichdan, public relations director at state-owned mining holding company MIND ID, explained to lawmakers that while 80 percent of the raw materials for nickel-based EV batteries were sourced from nickel ore, Indonesia, the world's largest nickel producer, would still need to import the remaining 20 percent.

"For example, we have been importing lithium hydroxide from China, Chile and Australia to meet the annual demand of around 70,000 tonnes," Dany told a meeting with House of Representatives Commission VII overseeing energy and mineral resources on Sept. 19, 2022.

The IEA also noted the resurgence of LFP batteries over the last two years, driven by China, due to high prices of battery metals.

At a separate meeting with House Commission VI the week before on Sept. 12, Indonesia Battery Cooperation president director Toto Nugroho explained that this posed a challenge that the government aimed to tackle through various strategies, including a possible acquisition of lithium mines abroad.

There appears to be interest in Australia, the world’s leading lithium producer, to cooperate with Indonesia for supplying the resource.

“What better opportunity to capitalize on the Indonesia-Australia Comprehensive Economic Partnership Agreement than to, for example, build a supply chain of lithium from Australia where it’s mined for processing here in Indonesia? Then, [the batteries] could be exported from Indonesia to the US, for example,” Steven Ciobo, Australia’s former minister for trade, tourism and investment, said during BNI Investment Daily Summit 2022, broadcast live on Oct. 19.

Read also: No US EV company has submitted an investment application: Govt

Nevertheless, Hermawan Wijaya, marketing director of battery maker PT International Chemical Industry, widely known for its ABC battery brand, suggested the government to focus on developing the domestic EV battery market, noting the lack of local battery makers that also focused on product application, as most batteries produced in Indonesia were exported.

“There needs to be a regulation forcing industrial development for the next five to six years, aimed at overseas buyers. At least by that point, an increase in nontax state revenue can be expected,” he told the Post on Wednesday.

“Once the industry is ready, domestic market obligation [DMO] can be put in place to encourage supporting industries,” Hermawan said.

Tenggono Chuandra Phoa, secretary-general of the Indonesian Electric Vehicle Industry Association (Periklindo), said even though Indonesia’s lithium needs were yet to match Thailand’s, it was important to develop a strategy to meet an expected surge in demand.

“Government efforts to accelerate [development of] the EV battery ecosystem in Indonesia are on the right track to ensure more affordable EVs, because the battery is the most expensive component of an EV,” he said by text message on Wednesday.

Dozens of battery-related development projects are ongoing in the country, mainly located in nickel-rich Sulawesi and North Maluku, including projects led by South Korea's LG Energy Solution as well as China’s battery manufacturing giant, Contemporary Amperex Technology.

Several local companies are building smelters to process nickel ore for battery feedstock. Others are focusing on manufacturing and/or distributing electric two-wheelers and commercial EVs, including buses and trucks, as electric cars remain unaffordable for most Indonesian consumers.

Still others are installing charging or battery swap stations, many collaborating with foreign companies to catch up on technology and for development aid.