- Banking

- 4 min read

Private banks bullish on branch expansion while PSU banks scale digital operations

Private banks including HDFC Bank, ICICI Bank and Axis have been spending a lot on expanding their operations into the hinterlands of the country, contrary to public sector banks which have been investing in building capabilities and enhancing their digital functions. What’s driving this change? Is phygital the new norm in banking? Find out more here.

Despite ‘digital’ being the buzzword, data suggests that private banks have been investing heavily in branch expansion for tapping into retail loans that have driven their loan portfolios in the last few quarters.

As corporates flock to markets due to the high-interest rates in banks, private banks have been rapidly expanding their footprint into underpenetrated markets, especially amidst a liquidity crunch.

For instance, HDFC Bank’s CFO Srinivasan Vaidyanathan said, “It's not a function of whether we know which locations and how many we want to open. It's a question of getting the least consummated in an appropriate manner and getting the fitment done on time. It's just a function of that.”

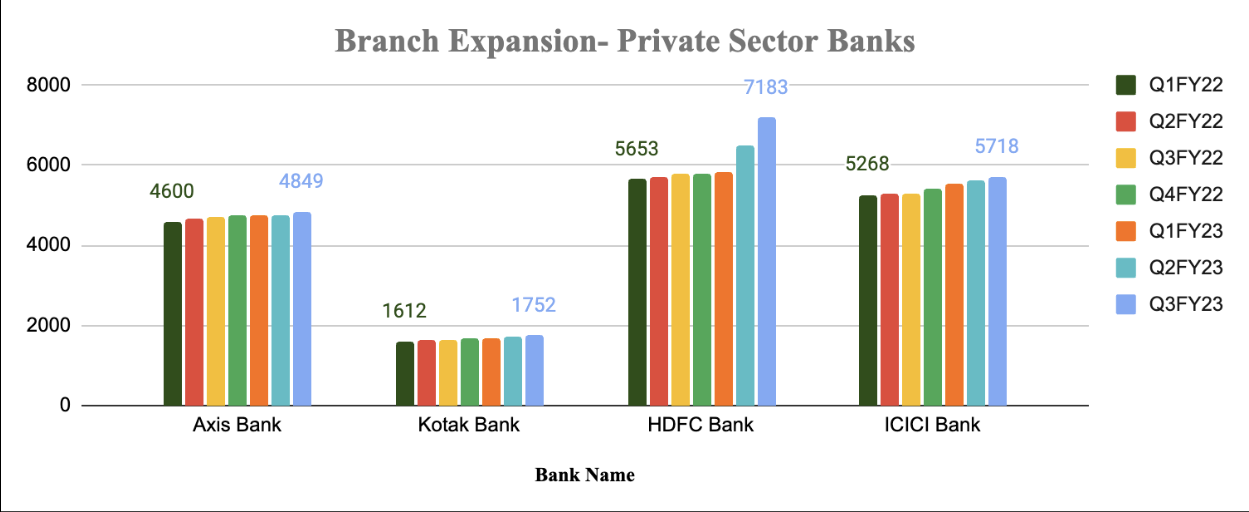

Branch expansion

Source: Analyst & Investor presentations of banks

Private sector banks have been expanding their footprint both in urban and rural areas to garner deposits, which has been a major issue amid a liquidity crunch in the banking system. India’s largest private sector bank HDFC Bank has added a huge 1,530 branches in the last seven quarters. ICICI Bank is a distant second, with a net addition of 450 branches. Axis Bank stands at 249 and Kotak at 140. India’s largest bank SBI added only 157 branches, taking its tally to 22,381 branches across the country. Bank of Baroda, on the other hand, has been adding less number of branches and reducing the number of employees.

Speaking to ETBFSI, a Bank of Baroda official said, “The lower expansion of branches by PSU banks in recent years is mainly due to rationalisation of branches on account of amalgamation/merger of PSU banks. However, there is an increase in the number of rural branches by PSU banks, which is reflected in the share of rural branches to total branches that have improved from 31.60% in September 2021 to 32.03% in September 2022.”

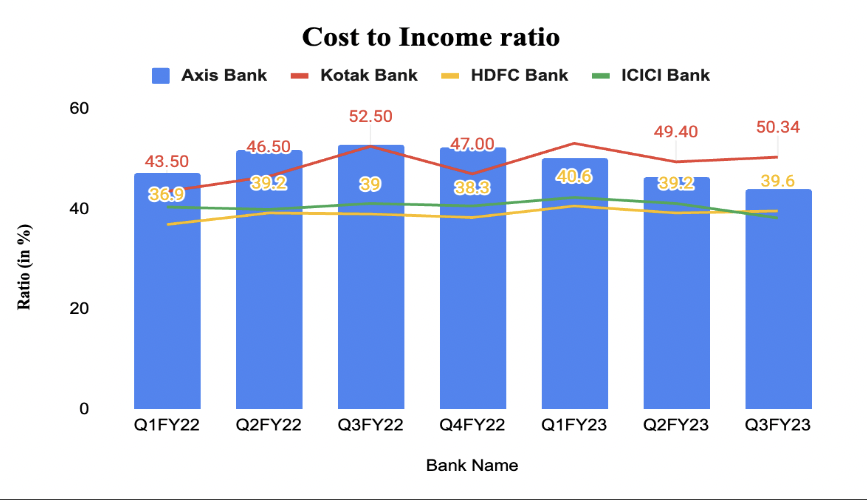

Operational costs

Source: Analyst & Investor presentations of banks

Branch expansion is a costly affair. Increasing physical presence also means increasing costs. The cost-to-income ratio is a significant determinant of how efficiently banks are managing their expenses with respect to income earned. ICICI Bank and Axis Bank have been able to bring down costs significantly However HDFC Bank’s rise in cost-to-income ratio has raised analyst concerns. Kotak Mahindra Bank has also seen the costs rise, despite relatively fewer branch additions.

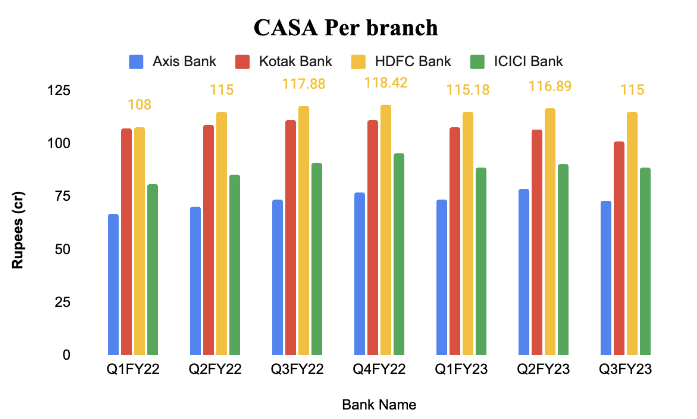

CASA- the sweet spot for banks

Source: Analyst & Investor presentations of banks

Current Accounts and Savings Accounts (CASA) are crucial for banks as they don’t have to pay any interest on these deposits. CASA per branch has been on the rise for all banks barring Kotak Bank, which has seen a tad bit of a slowdown in CASA per branch.

Market share

Apart from deep penetration into markets, banks also intend on increasing their market share by opening new branches. HDFC has gained the most market share, as compared to its peers.

Source: Tijori Finance, Analyst Presentations

RUSU Areas- the game changers

The rural and semi-urban markets (RUSU) have been a target area for all these banks. In HDFC Bank’s case, 52% of its branches are in RUSU areas, up from 50% in Q1FY22. ICICI’s branches in RUSU also increased from 40% in Q1FY22 to 51.7% in Q3FY23. Axis Bank has 54% and Kotak Mahindra Bank has 34% branches in these areas respectively.

“RUSU (rural and semi-urban) markets are an important growth area for us and we see significant opportunity to gain market share in these regions while driving higher profitability. We achieved a strong 28% YOY growth in disbursements across all the major product segments and delivered 46% YOY growth in rural loan book,” says Amitabh Chaudhary, CEO, Axis Bank.

Explaining its rationale for branch expansion HDFC Bank said it would like to reduce the kind of travel that sales relationship managers have to do to meet their customer or prospective customer, from 4.5 or 6 kilometers to 1-2 kilometres to get in better productivity and better influence to consummate the transaction rightly.

Is ‘phygital’ the new normal going ahead?

Although banks are adopting conventional methods of penetrating into the markets in a digital era, they are not discounting the use of mobile banking apps, which have helped them gain market share, especially with the millennials and Gen Z.

Quoting Uday Kotak, CEO at Kotak Mahindra Bank, “We will continue to steadily add branches. We believe branches still continue to be important. Our view however is that the density requirements of branches compared to the past may be less, therefore branches are still needed. But instead of being at a distance of 100 metres from your home, I’m sure people can live with a branch which is half a kilometre or a kilometre from the home. So, that continued steady increase in branches, not dramatic, more focused, also more focused on the current account customers, because interestingly we find the savings account customers are moving much more digitally compared to the current account customers and therefore technology is the place where we are putting the money.”

All in all, private banks are extremely bullish on branch expansion while simultaneously increasing their digital footprint, which will eventually lead to them becoming market leaders.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions