- Banking

- 4 min read

Explained: India’s gold loan market, share of banks and NBFCs

NBFCs are facing stiff competition from banks. Despite India being the largest market for gold loans, why have banks just woken up now and are expanding aggressively? Are they sensing some big opportunity? Will this adversely affect the NBFCs that have established a niche in the market? Here's a detailed explainer of the gold loan industry and the presence of each stakeholder.

A few years back, if one visited the hinterlands of Kerala, far from the main cities of Kochi, Thiruvananthapuram and Kozhikode, one will spot at least one branch of Muthoot Finance or a Manappuram Finance company in every nook and corner of the village. However, in the last few years, banks are seizing the opportunity and one can gradually see gold loan branches of larger banks mushrooming in the hustling and bustling streets of these villages.

India, the biggest market for gold financiers:

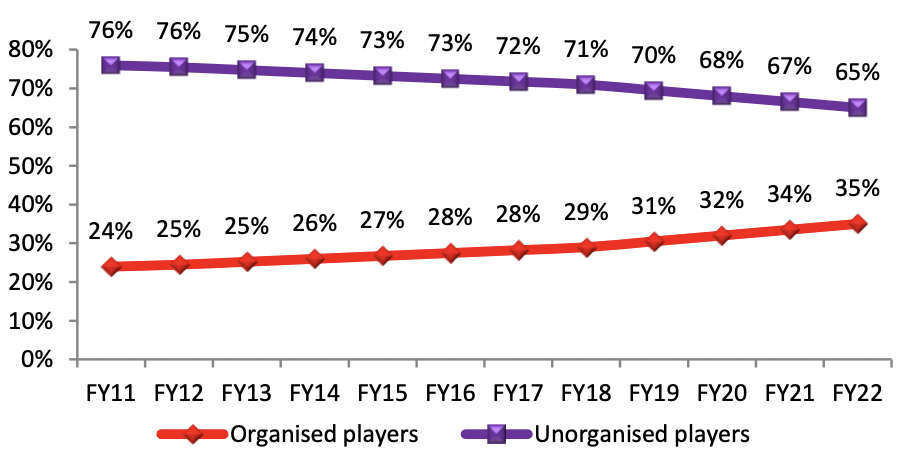

Data from the RBI suggests that the gold loan disbursals have almost doubled from Rs.46791cr in September 2020 to Rs.80617cr in September 2022. It also states that India owns more than 27000 tonnes (14% of the world’s gold) of which, around 5,300 tonnes is pledged. As unorganized players like moneylenders and pawnbrokers occupy a large chunk of the market i.e. 65%, and the remaining 35% is banks and NBFCs (organized market).

A report by Systematix suggests that India’s gold market is grossly underpenetrated at just 7%. If one looks at the gold holdings in Indian households, there is room for organized gold-loan financiers as even 1% additional penetration could drive 15% growth for the entire organized segment, which is also evident from the graph given below.

How are organized players standing out from unorganized players?

The table given below shows how banks, NBFCs and unorganized players like moneylenders and pawnbrokers.

Banks go big on gold- double down on branches, see disbursals surge

In the last few quarterly results, it is evident that banks have increased their disbursals in this category. For instance, SBI has seen a 21% growth in the retail gold loan segment. Bank of Baroda had seen a whopping 62% increase, HDFC at 23% and Axis Bank at 26%. The organized gold loan market is a 6 trillion industry, out of which there is an 80:20 split between banks and NBFCs.

Earlier, 72% of the gold loan portfolio came from agriculture gold loans, as the RBI had mandated banks to lend a specific amount to priority sectors like agriculture. Banks resorted to these as they helped them meet RBI’s targets and similarly in a much safer way. However, there are plenty of defaults along with fewer yields, so banks started pivoting from the gold loan segment.

Nonetheless, banks are improving their visibility in the gold loan segment by opening branches. Kotak recently launched 100 gold loan branches in FY23 and plans to add 50 more. HDFC is increasing their branch count to 5000.

“Indians have idle Gold and with Gold prices soaring, Gold Loans have become an attractive proposition. The demand is also coming from people moving away from unorganized sources of finance, such as pawnbrokers and moneylenders. This is due to greater awareness of risks associated with unregulated sources of finance offered by pawnbrokers, at relatively higher interest rates. We feel the trend will continue in the time to come as well.” says Manish Kothari, President & Head – Commercial Banking, Kotak Mahindra Bank Limited.

Additionally, CSB Bank’s Pralay Model in the Q3FY23 Analyst meeting said that the bank witnessed 51% growth in disbursals, out of which 40% came from balance transfers of NBFCs, which indicates how consumers are gradually shifting towards banks over NBFCs.

NBFCs losing market share, despite growth in the gold loan market

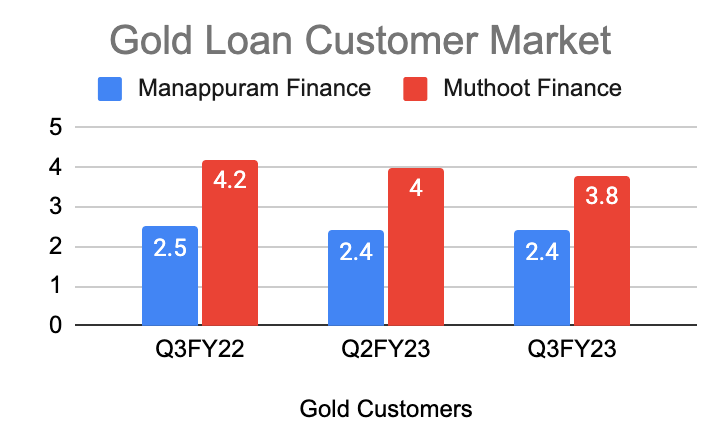

Manappuram Finance and Muthoot Finance are two large NBFC players specializing in this segment. The graph given below shows how customers have been dropping from these NBFCs.

Additionally, the advance mix for gold has been decelerating for these NBFCs.

Speaking about the competition, George Alexander Muthoot, MD of Muthoot Finance Ltd says, “New players, whether banks or NBFCs, are starting to realize that the gold loan business is not a ‘bed of roses’. Banks and NBFCs are starting to face issues with gold loans. It is operationally quite challenging and intensive business.”

The way forward

As far as the road ahead is concerned, Aniket Dani, Director at Crisil Research adds that typically, banks should focus on higher-ticket size customers, with loans ranging between Rs 2 lakh and Rs 5 lakh, with the advantage of lower interest rates but higher turnaround time and NBFCs should focus on ticket sizes in the Rs 0.5-2.0 lakh bracket, with higher interest rates, faster TATs, and strong branch network. These distinct offerings and focus areas of different players will help them coexist and venture into the untapped market in the longer run.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions