Mary D'Onofrio

More posts from Mary D'Onofrio

Today there are over 1,000 private companies valued at $1 billion or more by their investors. In fact, approximately one-and-a-half unicorns are born a day. But that was not always the case, nor, we believe, the intention.

When the term unicorn was originally coined 10 years ago, it provided a vaunted distinction for the 14 private startups that were valued at $1 billion or more at the time; and, only four unicorns were added yearly. Back then, it was an exceptional accomplishment and a genuine proxy for success that signaled to customers, partners, employees and the media that this company should be taken seriously because it would likely endure.

The list included the likes of Palantir, Pinterest, Uber, Square and Airbnb, all of which continue to be active influencers of how we live and work. But even the original unicorn list had some companies that did not stand the test of time as meaningfully, such as Fab.com.

Fast-forward to today, and the proliferation of unicorns has gotten out of hand. Thanks to a 13-year bull market that propelled software IPO and M&A outcomes to new heights, and an abundance of capital in the venture ecosystem, private software valuation multiples have skyrocketed.

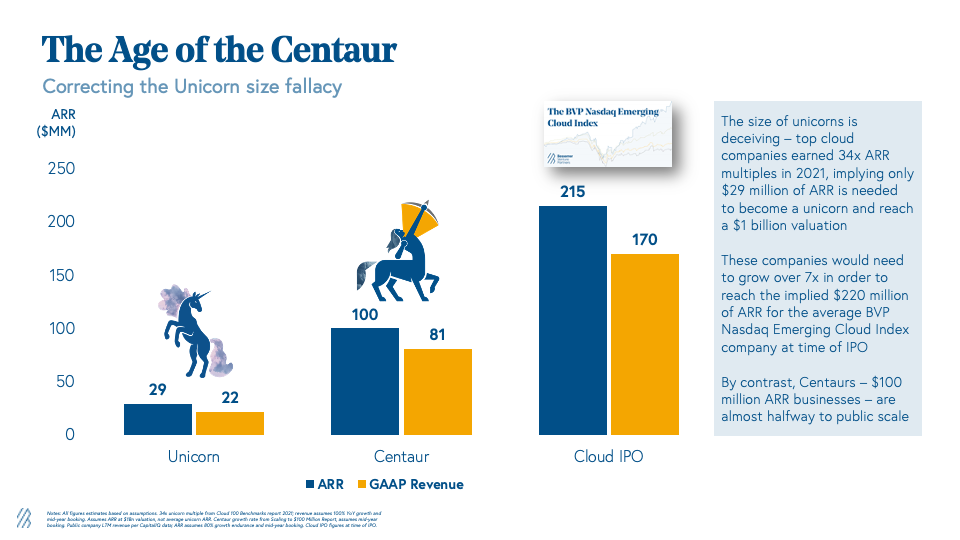

As investors rationalized a way to underwrite outcomes to 30x, 40x, 50x+ multiples, the once rare billion-dollar valuation became ordinary and inconsequential. As we highlighted in Bessemer’s 2021 Cloud 100 Benchmarks report, the average entry multiple for a top cloud company increased from 9x annual recurring revenue (ARR) in 2016 to 34x in 2021. This dynamic has led to this misperception on the size of unicorns.

Unicorns can be illusions, often appearing a lot bigger than they are in reality. At a 34x ARR multiple, a company only needs $29 million in ARR to achieve unicorn status. For a $29 million ARR company growing at 100%, a 34x ARR multiple also equates to a 45x current revenue multiple ($22 million of GAAP revenue with midyear booking).

Venture investors correctly use ARR to evaluate private cloud companies’ performance to reflect their rapid growth rates. However, the ARR metric overstates revenues by annualizing annual contract values and crediting the business with annual customer retention.

While hitting $29 million ARR is a fantastic accomplishment, across the BVP Nasdaq Emerging Cloud Index, the average LTM GAAP revenue at time of IPO was a staggering $170 million. In other words, many top cloud unicorns still have the formidable undertaking of growing their revenue another 7x to hit average IPO scale.

For the last few years, investors and startups were able to justify all of this by pointing to public market multiples ascribed to cloud dollars. The increase in multiples to 34x from 9x suggests that private markets found every $1 of revenue at a top cloud business to be 4x more valuable in 2021 than in 2016, and public markets largely played along.

But do dollars actually become that much more valuable? The recent market correction suggests that they do not. The average public cloud multiple has only increased to 13x in 2022 YTD from 11x in 2013 (median from 7x to 10x). So, while cloud dollars are more valuable than before — driven by high growth endurance and predictability — they are not valuable enough to rationalize the increase in private market entry prices that could crown a unicorn with $29 million ARR.

With this market correction (and sticking with the equine metaphor), we will see some unicorns strolling into the sunset and others being sold for slaughter. Whereas in the past entrepreneurs and investors alike strived to attain “unicorn status” as an imprimatur of success, it is no longer a proxy for market leadership, quality metrics or lasting endurance — as recent headlines corroborate. The only thing we can confidently conclude about a unicorn today is the ability to fundraise during the frothiest period of the last decade.

While it is tempting to find another, loftier valuation milestone to replace the unicorn, the current environment demands a return to business metrics that cannot be so easily gamed. The reality is that it only takes one eager investor at a $1 billion valuation to confer unicorn status on a startup.

Instead, founders, CEOs, company executives, employees — and yes, VCs — need a milestone that is rooted in business fundamentals and divorced from the ebullient market sentiment of the moment. We need one that belongs entirely to the company and reflects its command of its business. The milestone that makes the most sense is $100 million in ARR, which we at Bessemer are naming a “centaur.”

Why is becoming a centaur the correct milestone for cloud founders to strive for? At $100 million ARR, the startup is an undeniable success. It is impossible to build a $100 million ARR business without strong product-market fit, a scalable sales and marketing organization, and a critical mass of customer traction that allows the company to plan its next steps well into the future.

Generous venture funding may still propel startups to centaur status when those funds are used to successfully market products to potential customers, and some may get there through inorganic growth, but it will always be an elite subset of startups. Unlike fallen unicorns that have captured recent headlines, we have yet to identify a centaur that shut down.

With an estimated 150 private cloud centaurs in the world, these businesses are truly rare. But in naming this new creature “centaur,” we are also indicating that $100 million ARR is the north star entrepreneurs and investors should align themselves with.

Finding and building a centaur

Entrepreneurs can build a centaur in almost any cloud subsegment. We have found centaurs in segments from sales, marketing and customer experience software (e.g., Podium, Gong) and fintech (e.g., Stripe, Plaid) to security (e.g., Tanium, Snyk), with no segment representing more than 20% of the total list.

Centaurs can also emerge from one of three different financing and growth strategies: traditional venture funding (e.g., Figma, Pendo), bootstrapping (e.g., Zapier, Cloudinary), and inorganic (e.g., Hopin). But a unifying theme across many centaur growth stories is that they often need to develop an “Act 2” product, segment or geography.

As an example, for ServiceTitan, this came in the form of layering in payments with their core vertical software offering, and expanding its core segments from HVAC, plumbing and electric to roofing. The vehicle of expansion is often different, but these businesses are generally able to expand their TAMs and continue strong customer acquisition and ACV growth well into maturity.

Reaching centaur status is enough to demarcate an enduring business, but it is not enough to reach exit velocity. Centaurs must also distinguish themselves with their other business metrics. The average BVP Nasdaq Emerging Cloud Index business was growing 65% at time of IPO, which implies an 81% growth rate the year before IPO given the 80% public cloud growth endurance heuristic.

Centaurs should strive to grow quickly enough to hit this exit velocity, following the path of companies like Zoom and Smartsheet, which also benefitted from strong net retentions (120%+), gross margins (70%+) and pathways to profitability. Many lower-growth centaurs often end up being private equity targets. Regardless of the exit type, they endure.

How do we align the venture ecosystem with this new measure of success?

For founders and executives: Stop conflating a fundraising milestone with a business milestone. While a $1 billion valuation is a fantastic achievement, it is not necessarily reflective of the health of the business or even a promising future. The business goal should be to drive the go-to-market motion, product innovation and hiring decisions that will propel you to build a business that can reach exit velocity. You should want to be the founder of a “centaur” not a “unicorn.”

For employees: When evaluating startup offers, do not solely consider the last fundraising milestone as indicative of a lower-risk and higher-reward opportunity. Revenue traction, momentum and potential are the best way to determine how your equity may grow. When mispriced, in a frothy environment $1 billion+ valuations can be more hurtful than helpful, as 409A prices are tied to already lofty marks. For the most part, centaurs are de-risked, while many unicorns are certainly not.

For VCs: Let’s celebrate founders and companies that share revenue numbers. At Bessemer, we were thrilled to celebrate Cloudinary and Zapier’s public announcements of becoming centaurs. In our board roles, let’s focus our companies on driving early go-to-market traction to justify any capital investment and not accept high-priced markups that don’t bring the startup closer to $100 million ARR. Instead of including in our bios how many unicorns we have backed, let’s include how many centaurs we have backed.

Reaching the new cloud milestone

Where a $1 billion valuation was once a distinction, it is now prosaic. What is not, however, is becoming a centaur — reaching the $100 million ARR threshold that connotes having the product, go-to-market and operational competencies to endure. Join the elite ranks of Plaid, Carta, Airtable, Fivetran, MessageBird, Ramp, Yotpo, Invision, Podium and Stripe by working to become a centaur, too.

Comment